UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant | ||||||

Filed by a Party other than the Registrant | ||||||

Check the appropriate box:

| Preliminary Proxy Statement | ||

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

Definitive Proxy Statement | ||

Definitive Additional Materials | ||

Soliciting Material Pursuant to |

Landauer, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ||||||

| x | ||||||

| No fee required. | ||||||

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||||||

| (1) | Title of each class of securities to which transaction applies:

| |||||

| (2) | Aggregate number of securities to which transaction applies:

| |||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||||

| (4) | Proposed maximum aggregate value of transaction:

| |||||

| (5) | Total fee paid:

| |||||

| Fee paid previously with preliminary materials. | ||||||

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||||||

| (1) | Amount Previously Paid: | |||||

| (2) | Form, Schedule or Registration Statement No.: | |||||

| (3) | Filing Party: | |||||

| (4) | Date Filed: | |||||

February 2, 2015

Dear Landauer Stockholder:

On behalf of Landauer, Inc. (the “Company”), we are pleased to invite the stockholders of the Company to attend the Annual Meeting of Stockholders of Landauer, Inc., to be held on March 6, 2015, at 10:00 a.m., local time, at 8755 West Higgins Road, Chicago, Illinois.

Fiscal 2014 was a challenging year for the Company and we performed below our expectations. The Board has taken significant actions in response. We made changes to our Chief Executive Officer and Chief Financial Officer positions. With regard to our corporate governance structure, we adopted majority voting for uncontested director elections and are asking shareholders to approve an amendment to our certificate of incorporation that would begin the process of declassifying our board. With regard to our executive officer compensation program, we made numerous changes, including modifying our incentive plans so that all benefits are now double trigger, clarifying and limiting the circumstances in which we can make adjustments and amendments to performance measures for outstanding performance awards, modifying the treatment of awards upon a termination without cause and enhancing our disclosure. More detail about all of these changes can be found in the proxy statement that this letter accompanies.

Your vote at the Annual Meeting is very important. Whether or not you plan to attend the meeting, we urge you to vote either via the Internet, by telephone or by signing and returning a proxy card. Please vote as soon as possible so that your shares will be represented.

Thank you for your continued support of Landauer.

Sincerely,

Michael T. Leatherman

President and Chief Executive Officer

Robert J. Cronin

Chairman of the Board of Directors

| 1 | ||||||||

| 1 | ||||||||

| 2 | ||||||||

| 4 | ||||||||

| 5 | ||||||||

| 6 | ||||||||

| 7 | ||||||||

LANDAUER, INC.

2 SCIENCE ROAD,

GLENWOOD, ILLINOIS 60425-1586

TELEPHONE (708) 755-7000

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Date: | March 6, 2015 | |

Time: | 10:00 a.m. Central Standard Time | |

Place: | 8755 West Higgins Road Chicago, Illinois 60631 | |

Notice is hereby given that the Annual Meeting of Stockholders of Landauer, Inc. will be held at 8755 West Higgins Road, Chicago, Illinois, at 10:00 a.m., local time, on Thursday, February 21, 2013Friday, March 6, 2015 for the following purposes:

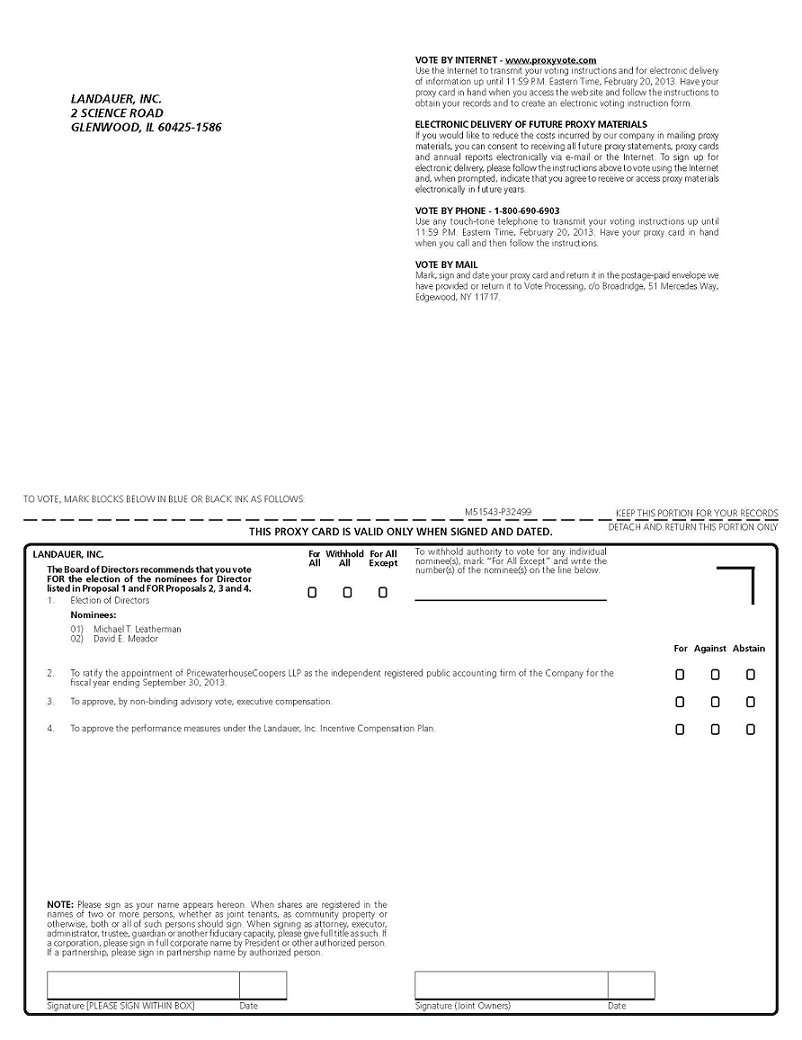

| (1) | To |

| (2) | To vote on the proposal to ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm of the Company for the fiscal year ending September 30, | |||

| (3) | To | |||

| (4) | To approve, by non-binding advisory vote, | |||

| (5) | To transact such other business as may properly come before the meeting. |

Only stockholders of record at the close of business on December 27, 2012February 2, 2015 are entitled to notice of and to vote at the meeting.

IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE MEETING. WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, THE COMPANY STRONGLY URGES YOU TO VOTE VIA THE INTERNET, TELEPHONE, OR REQUEST A PAPER PROXY CARD TO COMPLETE AND RETURN BY MAIL. IF YOU ATTEND THE MEETING AND VOTE IN PERSON, YOUR PROXY WILL NOT BE USED.

MICHAEL K. BURKEMARK A. ZORKO

Senior Vice President andInterim Chief Financial Officer

January 7, 2013February 2, 2015

REVIEW YOUR PROXY STATEMENT AND VOTE IN ONE OF FOUR WAYS: | ||||||

| VIA THE INTERNET Visit the web site listed on your proxy card |  | BY MAIL Sign, date and return your proxy card in the enclosed envelope | |||

| BY TELEPHONE Call the telephone number on your proxy card |  | IN PERSON Attend the Annual Meeting in Chicago, Illinois | |||

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on March 6, 2015. Our Proxy Statement and the Landauer, Inc. Annual Report for 2014 are available online atwww.proxyvote.com or at our investor relations website.

Proxies and Voting Information | PROXY STATEMENT | |

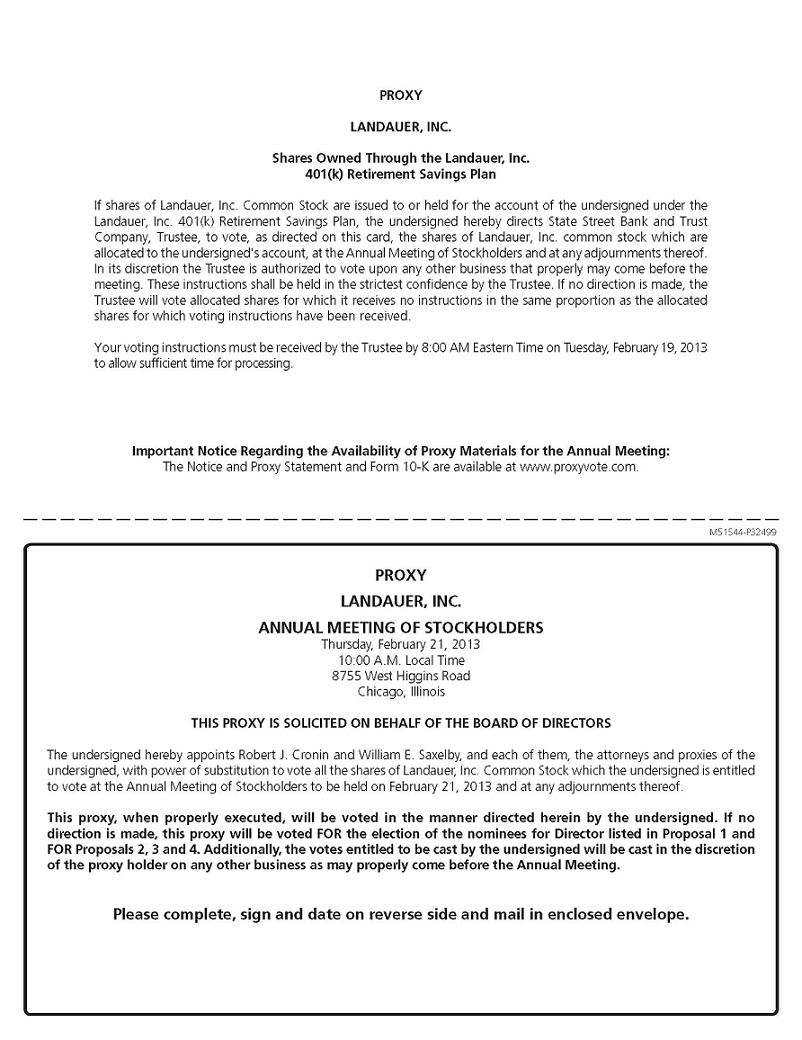

We are providing this proxy statement to you in connection with the solicitation of proxies by the Board of Directors of Landauer, Inc. for the 2014 Annual Meeting of Stockholders and for any adjournment or postponement of the meeting (the “Annual Meeting”). We expect to begin mailing our proxy materials on or about February 4, 2015.

Time and Place: We are holding the Annual Meeting at 10:00 a.m. Central Standard Time on Friday, March 6, 2015, at Landauer Inc., 8755 West Higgins Road, Chicago, Illinois.

Attendance Requirements: You may attend the Annual Meeting and vote in person even if you have returned a proxy in writing, by telephone or through the Internet.

Street-Name Holders: If you hold shares in a bank or brokerage account (known as shares held in “street name”), you must obtain a valid “legal proxy,” executed in your favor from the holder of record, if you wish to vote these shares at the meeting.

Matters for Stockholder Voting

At this year’s Annual Meeting, we are asking our stockholders to vote on the following matters:

| Proposal | Board Recommendation | Rationale for Board Recommendation | ||||

| 1. | Election of Directors Stephen C. Mitchell Thomas M. White |

| • Broad mix of backgrounds with operating, financial & governance experience | |||

| 2. | Ratification of auditor Ratification of appointment of PricewaterhouseCoopers LLP |

| • Independent, with limited ancillary services | |||

| 3. | Amend Certificate of Incorporation to declassify Board |

| • Improved corporate governance practice | |||

| 4. | Say-on-pay Advisory vote to approve the compensation for named executive officers |

| • Strong linkage of pay for performance • Balanced compensation program aligning interests with shareholders |

How to View Proxy Materials Online

Our Proxy Statement and the Landauer, Inc. Annual Report for 2014 are available online atwww.proxyvote.com.

| 1 |

PROXY STATEMENT | ||

APPROXIMATE DATE OF NOTICE: JANUARY 7, 2013

FEBRUARY 2, 2015

INFORMATION CONCERNING THE PROXY SOLICITATION

This proxy is solicited by the Board of Directors of Landauer, Inc. (the “Company”, “we”, “our”, “us” or “Landauer”) on behalf of the Company for use at its Annual Meeting of Stockholders to be held on Thursday, February 21, 2013Friday, March 6, 2015 at 8755 West Higgins Road, Chicago, Illinois, at 10:00 a.m., local time, or any adjournments or postponements thereof. You may revoke your proxy at any time prior to it being voted by giving written notice to the Secretary of Landauer, by submission of a later dated proxy or by voting in person at the meeting. The costs of solicitation will be paid by Landauer. Solicitations may be made by the officers and employees of Landauer personally or by telephone.

In accordance with rules and regulations adopted by the U.S. Securities and Exchange Commission, instead of mailing a printed copy of its proxy materials to each stockholder of record, Landauer furnishes proxy materials on the Internet. You will not receive a printed copy of the proxy materials, unless specifically requested. This process is designed to expedite stockholders’ receipt of proxy materials, lower the cost of the Annual Meeting and help conserve natural resources.

On or around January 7, 2013,February 4, 2015, the Company mailedwill mail to its stockholders, other than those who previously requested electronic or paper delivery, a Notice Regarding the Availability of Proxy Materials (the “Notice”), which contains instructions as to how you may access and review all of the Company’s proxy materials including the Proxy Statement and 20122014 Annual Report on Form 10-K, on10-K. The proxy card included with the Internet. The Notice alsomaterials instructs you as to how you may vote your proxy on the Internet or by telephone. However, if you would prefer to receive printed proxy materials, please follow the instructions for requesting such materials as contained in the Notice.

The Securities and Exchange Commission’sSEC’s rules permit the Company to deliver a single Notice or set of Annual Meeting materials to one address shared by two or more of the Company’s stockholders. This delivery method is referred to as “householding” and can result in significant cost savings. To take advantage of this opportunity, Landauer has delivered only one Notice or set of Annual Meeting materials to multiple stockholders who share an address, unless the Company received contrary instructions from the impacted stockholders prior to the mailing date. Landauer agrees to deliver promptly, upon written or oral request, a separate copy of the Notice or Annual Meeting materials, as requested, to any stockholder at the shared address to which a single copy of those documents was delivered. If you prefer to receive separate copies of the Notice or Annual Meeting materials, contact Broadridge, Householding Department, 51 Mercedes Way, Edgewood, NY 11717 or by telephone at 800-542-1061. If you are currently a stockholder sharing an address with another stockholder and wish to receive only one copy of future Notices or Annual Meeting materials for your household, please contact Broadridge at the above phone number or address.

On December 27, 2012,January 29, Landauer had outstanding 9,468,4859,560,674 shares of Common Stock, which is its only class of voting stock, held of record by 290246 holders. Only stockholders of record at the close of business on December 27, 2012February 2, 2015 will be entitled to receive notice of and to vote at the meeting and any adjournments or postponements thereof. With respect to all matters that will come before the meeting, each stockholder may cast one vote for each share registered in his or her name on the record date.

The shares represented by every proxy received will be voted, and where a choice has been specified, the shares will be voted in accordance with the specification so made. If no choice has been specified on thea proxy that has been signed and returned, the shares will be voted FOR the election of the nominees as directors, FOR the ratification of the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm, FOR the proposal relatingapproval of an amendment to the Company’s executive compensation,Certificate of Incorporation, as amended (the “Certificate”), to declassify the Board of Directors, and FOR the proposal relating to approval of, the performance measures under the Company’s incentive compensation plan.by non-binding advisory vote, executive compensation. The proxy also gives authority to the proxies to vote the shares at their discretion on any other matter presented at the meeting. If a proxy indicates that all or a portion of the shares represented by such proxy are not being voted with respect to a particular proposal, such non-voted shares will not be considered present and entitled to vote on such proposal, although such shares may be considered present and entitled to vote on other proposals and will count for the purpose of determining the presence of a quorum. An abstention with respect to a proposal has the effect of a vote against a proposal. “Broker non-votes” are counted toward the quorum requirement but they do not affect the determination of whether a matter is approved. A broker non-vote occurs when a broker cannot vote on a matter because the broker has not received instructions from the

| 2 |  |

Information Concerning the Proxy Solicitation | PROXY STATEMENT | |

beneficial owner and lacks discretionary voting authority with respect to that matter. It is expected that brokers will lack discretionary voting authority with respect to the election of nominees as directors, the proposal regardingapproval of an amendment to the non-binding advisory voteCertificate to approve executive compensationdeclassify the Board of Directors, and the proposal relating to approval, by non-binding advisory vote, of the performance measures under the Company’s incentive compensation plan, but will not lack discretionary voting authority with respect to the proposal regarding ratification of the independent registered public accounting firm at the Annual Meeting.

| 3 |

BENEFICIAL OWNERSHIP OF COMMON STOCK

The following table provides information as of November 30, 2012January 29, 2015 concerning beneficial ownership of Common Stock by each person known by Landauer to own beneficially more than 5% of the outstanding shares of Common Stock, each director, each director nominee, each executive officer named under the caption “Executive Compensation” and all directors and executive officers as a group. Unless otherwise noted, the listed persons have sole voting and dispositive powers with respect to shares held in their names, subject to community property laws, if applicable. Percentage ownership is based on an aggregate 9,560,674 shares of Common Stock outstanding on January 29, 2015. Unless otherwise noted, the address of each beneficial owner is c/o Landauer, Inc., 2 Science Road, Glenwood, Illinois 60425-1586.

| Name of Beneficial Owner | Number of Shares Beneficially Owned | Percent Of Class | Number of Shares Beneficially Owned | Percent of Class | ||||||

| T. Rowe Price Associates, Inc.(1) | 769,380 | 8.1% | ||||||||

| Royce & Associates, LLC | 755,871 | 8.0% | 1,060,400 | 11.1 | % | |||||

T. Rowe Price Associates, Inc.(2) | 756,720 | 7.9 | % | |||||||

| BlackRock, Inc.(3) | 713,399 | 7.5% | 887,339 | 9.3 | % | |||||

| Neuberger Berman Group LLC(4) | 667,543 | 7.1% | ||||||||

| The Vanguard Group, Inc. | 489,448 | 5.2% | 615,831 | 6.4 | % | |||||

| William E. Saxelby(6) | 90,660 | * | ||||||||

| R. Craig Yoder(7) | 52,421 | * | ||||||||

| Robert J. Cronin(8) | 21,690 | * | ||||||||

RidgeWorth Capital Management, Inc. as Parent Company for Ceredex Value Advisors LLC(5) | 528,924 | 5.5 | % | |||||||

William E. Saxelby | 65,039 | * | ||||||||

R. Craig Yoder | 35,861 | * | ||||||||

Robert J. Cronin | 24,044 | * | ||||||||

| Thomas M. White | 9,616 | * | 13,470 | * | ||||||

| Stephen C. Mitchell | 9,015 | * | 12,869 | * | ||||||

| Michael T. Leatherman | 7,935 | * | 38,357 | * | ||||||

| Michael K. Burke | 7,153 | * | ||||||||

| William G. Dempsey | 7,038 | * | 10,894 | * | ||||||

| David E. Meador | 6,961 | * | 10,815 | * | ||||||

| Richard E. Bailey | 3,671 | * | ||||||||

| All directors and executive officers as a group (9 persons)(9) | 212,489 | 2.2% | ||||||||

Michael K. Burke | 6,119 | * | ||||||||

Michael P. Kaminski | 9,932 | * | ||||||||

Michael R. Kennedy | 7,416 | * | ||||||||

Mark A. Zorko | 2,000 | * | ||||||||

All directors and executive officers as a group (10 persons) | 130,942 | 1.4 | % | |||||||

*Less than one percent.

| * | Less than one percent. |

| (1) | As reported in a statement on Schedule 13G filed with the Securities and Exchange Commission on January 13, 2015. This stockholder’s address is 745 Fifth Avenue, New York, NY 10151. |

| (2) | As reported in a statement on Schedule 13G filed with the Securities and Exchange Commission on February |

| As reported in a statement on Schedule 13G filed with the Securities and Exchange Commission on January |

| (4) | As reported in a statement on Schedule 13G filed with the Securities and Exchange Commission on February |

| (5) | As reported in a statement on Schedule 13G filed with the Securities and Exchange Commission on February 6, 2014. This stockholder’s address is 3333 Piedmont Road NE, Suite 1500, Atlanta, GA 30305. |

|

Beneficial Ownership of Common Stock |

| |

Section 16(a) Beneficial Ownership Reporting Compliance

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires Landauer’s officers and directors and persons who beneficially own more than ten percent of Landauer’s Common Stock (“Reporting Persons”) to file reports of beneficial ownership and changes in such ownership with the Securities and Exchange Commission (“SEC”).SEC. Reporting Persons are required by SEC regulation to furnish Landauer with copies of all Section 16(a) reports they file and Landauer is required to post such reports on its website,http://www.landauer.com.

Based solely on a review of the Forms 3, 4 and 5 filings received from, or filed by Landauer on behalf of, Reporting Persons since the beginning of fiscal year 2012,2014, Landauer believes that all Section 16(a) filing requirements were met during fiscal year 2012.2014.

| 5 |

PROXY STATEMENT

| ||

ELECTION OF DIRECTORS

Members of Landauer’s Board of Directors are divided into three classes serving staggered three-year terms, with a total of nine directors authorized. No Directordirector will stand for election after their 72nd birthday. The terms of two of the sevensix current directors expire at the Annual Meeting. The two directors, Michael T. LeathermanStephen C. Mitchell and David E. Meador,Thomas M. White, are Landauer’s nominees for re-election to a three-year term.

Landauer’s bylawsby-laws provide that nominations for directorships by stockholders only may be made pursuant to written notice received at the Company’s principal office not less than 90, and not more than 120, calendar days prior to the first anniversary of the preceding year’s annual meeting. No such nominations were received for the meeting as of November 30, 2012.22, 2014.

Proxies may not be voted forIn December 2014, Landauer’s Board of Directors approved an amendment to the Company’s by-laws to change the election of directors to the Board from plurality to majority voting. Only directors that receive a greater number of persons than the two named nominees. Directors are elected by a pluralitymajority of the votes present in person or represented by proxy at the meeting and entitled to vote on thecast “FOR” their election of directors. Thus, assuming a quorum is present, the two persons receiving the greatest number of votes will be elected to serve as directors.elected. Accordingly, withholding authority to vote for a directorabstentions and broker non-votes with respect to the election of directors will not affect the outcome of the election of directors. In the event that an incumbent director is not re-elected, the Company’sGovernance and Nominating Standards require that director to tender his or her resignation for consideration by the Governance and Nominating Committee. The Governance and Nominating Committee will recommend to the Board of Directors whether to accept or reject the resignation, or whether other action should be taken. The Board of Directors will act on the resignation and publicly disclose its decision regarding the resignation and the rationale behind the decision within 90 days following certification of the election results.

Proxies may not be voted for a greater number of persons than the two named nominees. If a nominee should become unavailable for election, the persons voting the accompanying proxy may at their discretion vote for a substitute.

The Board of Directors recommends a vote FOR the re-election of Mr. Leatherman and Mr. Meador as directors of Landauer.

| Election of Directors | ||

| The Board of Directors recommends a vote FOR the re-election of Mr. Mitchell and Mr. White as directors of Landauer. | |

Certain information as to the two nominees for re-election at the Annual Meeting and each other person whose term of office as a director will continue after the meeting is set forth below. Certain individual qualifications, experiences and skills of the directors that contribute to the Board of Directors’ effectiveness as a whole are also described below. The nominees for re-election at the meeting are Mr. LeathermanMitchell and Mr. Meador.

Director Nominees:White.

| 6 |  |

| |||

| |||

Stephen C. Mitchell(2,3)

Since 2001, President, Knight Group LLC, a privately held firm providing services for the start-up and management of new ventures. Since 1995, Vice Chairman and Director, Knight Facilities Management, a company providing outsourcing of facilities management services for industrial and commercial clients worldwide. Until 2001, President, Chief Operating Officer and Director, Lester B. Knight & Associates, Inc., a company involved in the planning, design and construction of advanced technology research and development and manufacturing facilities.

Qualifications: Mr. Mitchell’s extensive leadership experience in various companies of diverse industry and size provides experience in operational and strategic leadership. He also has considerable corporate governance experience through years of service on other public company boards.

Current Directorships: None

Former Directorships: Mr. Mitchell completed his service as a Director of Apogee Enterprises, Inc., a manufacturer of glass products for the construction and art framing markets on June 21, 2014.

Age: 71

Director Since: 2005

Expiration of Current Term: 2015

Thomas M. White(1,2)

Since 2007, Operating Partner for Apollo Management L.P., a private equity firm. During 2013 and 2014, Interim Chief Operating Officer of CEVA Logistics, an Apollo owned entity in the Netherlands, which provides contract logistics and freight forwarding services. During 2011 and 2012, Chief Financial Officer of Constellium, an Apollo owned entity in France, which produces aluminum products. During 2009 and 2010, Chief Financial Officer of SkyLink Aviation, Inc., an Apollo owned entity in Canada, which provides air charter logistics services. From 2002 to 2007, Chief Financial Officer of Hub Group, Inc., a NASDAQ listed company which provides logistics services. Prior to joining Hub Group, Mr. White was an audit partner with Arthur Andersen, which he joined in 1979. Mr. White is a Certified Public Accountant.

Qualifications: Mr. White’s extensive experience as a senior executive of global companies provides in-depth knowledge in global operations, finance, international business and strategic planning. In addition, he brings financial acumen to Board discussions by virtue of his background as a Chief Financial Officer.

Current Directorships: Director of CEVA Group, PLC.

Former Directorships: Director of Quality Distribution, Inc, a NASDAQ listed company; Director of EVERTEC, Inc., a NASDAQ listed company; Director of FTD, Inc., a NYSE listed company and Director of SkyLink Aviation, Inc.

Age: 57

Director Since: 2004

Expiration of Current Term: 2015

Directors Continuing in Office:

| |||

| |||

| |||

| |||

| |||

Member of the (1) Audit Committee, (2) Compensation Committee, (3) Governance and Nominating Committee

| 7 |

PROXY STATEMENT | Election of Directors | |

Robert J. Cronin(1),(3)

Since 2001, Managing Partner, The Open Approach LLC, a provider of consulting services and investment banking to the printing industry. From November 2005 to April 2006, Chairman and Chief Executive Officer, York Label, Inc., a supplier of pressure-sensitive labels and related systems. Until January 2000, Chairman of the Board and Chief Executive Officer of Wallace Computer Services; previously President, Chief Executive Officer and Director; now retired. Wallace Computer Services is a provider of information management products, services and solutions.

Qualifications: Mr. Cronin’s experience as a Chairman and Chief Executive Officer at two companies provides valuable insight for the Company as to the issues and opportunities facing the Company, as well as experience in strategic planning and leadership of complex organizations. He also has considerable corporate governance experience through years of service in leadership positions with various public companies.

Current Directorships: Director of various privately held corporations.

Former Directorships: None

Age: 70

Director Since: 1997

Expiration of Current Term: 2017

William G. Dempsey(2,3)

Since 2007, retired and has been serving as Director of various public and private companies. From 1982 to 2007, various senior leadership positions with Abbott Laboratories including Executive Vice President, Global Pharmaceuticals from 2006 to 2007. Abbott Laboratories was a global, broad-based health care company devoted to discovering new medicines, new technologies and new ways to manage health. From 1977 to 1982, various positions with Sciaky Bros., a manufacturer of high tech electron beam, laser welding and heat treating systems.

Qualifications: Mr. Dempsey’s extensive experience as a senior executive with a global pharmaceutical company provides a wealth of health care experience in global healthcare markets including pharmaceuticals, nutrition and medical devices. Mr. Dempsey’s leadership experience provides expertise in strategy, marketing, international operations, manufacturing and managing research and development organizations.

Current Directorships: Director of Hospira, Inc.; and Director of Hill-Rom Holdings, Inc. Mr. Dempsey also serves on the Salvation Army Advisory Board in Chicago and is a member of the Board of Trustees of the Guadalupe Center in Immokalee, Florida.

Former Directorships: Director of MDS Inc.; Director of Nordion, Inc.; and Director of TYRX, Inc.

Age: 63

Director Since: 2008

Expiration of Current Term: 2017

Member of the (1) Audit Committee, (2) Compensation Committee, (3) Governance and Nominating Committee

| 8 |  |

Election of Directors | PROXY STATEMENT | |

Michael T. Leatherman

Since December 2014, President and Chief Executive Officer of Landauer, Inc. From September 2014 through December 2014, Interim President and Chief Executive Officer of Landauer, Inc. From September 2011 through December 2011, Interim Chief Financial Officer, Landauer, Inc. Since 2000, Independent Consultant primarily to the information technology industry. From 1990 to 2000, various senior leadership positions with Wallace Computer Services including Executive Vice President, Chief Information Officer and Chief Financial Officer from 1998 to 2000. From 1984 to 1990, Chief Executive Officer of FSC Paper Corporation, a subsidiary of Smorgon Consolidated Industries. Mr. Leatherman is a Certified Public Accountant.

Qualifications: Mr. Leatherman’s extensive experience as a senior executive with a wealth of information technology knowledge provides expertise in information systems strategy and project implementation, as well as expertise in general operational and strategic leadership. In addition, he brings financial acumen to Board discussions by virtue of his background as a Chief Financial Officer.

Current Directorships: None

Former Directorships: From 2006 to 2009, Director of Nashua Corporation, which was acquired by Cenveo, Inc.; and Director of a non-profit organization providing continuous care retirement services.

Age: 61

Director Since: 2008

Expiration of Current Term: 2016

David E. Meador(1,3)

Since 2014, Vice Chairman and Chief Administrative Officer, DTE Energy. From 2001 to 2014, Executive Vice President and Chief Financial Officer, DTE Energy. From 1997 to 2001, Vice President and Controller, DTE Energy. DTE Energy provides safe, reliable electric and natural gas services to Michigan businesses and homes and has energy related businesses and services nationwide. From 1983 to 1997, served in a variety of financial and accounting positions at Chrysler Corporation. Mr. Meador began his professional career with Coopers and Lybrand and is a Certified Public Accountant.

Qualifications: Mr. Meador’s experience as a senior executive with an energy company provides substantial experience in the nuclear power industry. Mr. Meador’s role as an active executive provides a perspective of a leader familiar with many facets of an enterprise facing the same set of current external economic and governance issues. In addition, he brings financial acumen to Board discussions by virtue of his background as a Chief Financial Officer.

Current Directorships: None

Former Directorships: None

Age: 57

Director Since: 2008

Expiration of Current Term: 2016

Member of the (1) Audit Committee, (2) Compensation Committee, (3) Governance and Nominating Committee

| 9 |

PROXY STATEMENT | Election of Directors | |

The executive officers of the Company are elected by its Board of Directors. Each serves until a successor is elected and qualified, or until the officer’s resignation or removal.

Mr. Leatherman’s biography can be found in the Directors Continuing in Office section of the Election of Directors section.

Mark A. Zorko

Mr. Zorko has served since June 2014 as Interim Chief Financial Officer of the Company. Mr. Zorko served as Senior Financial Advisor of the Company since April 2014. Prior to that time, Mr. Zorko served as the Chief Financial Officer of Steel Excel, Inc. (“SXCL”) until May 2013. He also served as the President and Chief Executive Officer of SXCL’s subsidiary Well Services Ltd. (“WSL”) in 2012 and Chief Financial Officer of DGT Holdings Corp. (“DGTC”) from 2006 through 2012. SXCL, WSL and DGTC are all affiliated with Steel Partners Holding, L.P., a publicly traded diversified global holding company. SXCL is primarily engaged in the oilfield service business and is publicly traded. DGTC was engaged in the business of x-ray imaging and power conversion subsystems worldwide. From 2000 to 2010, Mr. Zorko was a CFO Partner at Tatum, LLC, a professional services firm, where he held Chief Financial Officer positions with public and private client companies. Mr. Zorko is on the Board of Directors of MFRI, Inc., a publicly held company engaged in the manufacture and sale of piping systems and filtration products, Chairs the Audit Committee and serves on the Compensation and Nominations/Governance Committees. He previously chaired the Strategy Committee. He is also on the Audit Committee for Opportunity Int’l, a microfinance bank, and on the Finance Committee for the Alexian Brothers Health System. Mr. Zorko earned a BS degree in accounting from The Ohio State University and an MBA from the University of Minnesota. He is a Certified Public Accountant and a member of the National Association of Corporate Directors.

Age: 62

Position: Interim Chief Financial Officer

R. Craig Yoder

Dr. Yoder was elected to his position in February 2001, after serving as the Company’s Vice President of Operations since 1994 and Technology Manager since joining the Company in 1983. Prior to joining the Company, he was a member of the senior technical staff at Pennsylvania Power and Light, and at Battelle Pacific Northwest Laboratory

Age: 62

Position: Senior Vice President–Technology and International Business

Michael Kaminski

Mr. Kaminski joined the company in April 2013 as President, Radiation Measurement. Previously he was Chief Executive Officer and President of Stereotaxis and held other senior positions there since 2002. Prior to joining Stereotaxis, Mr. Kaminski spent nearly 20 years with Hill-Rom Company (Hillenbrand Industries), where he held several senior level positions. Mr. Kaminski earned an M.B.A. from Xavier University and a B.S. in Marketing from Indiana University.

Age: 54

Position: President, Radiation Measurement

| 10 |  |

| |||

| |||

| |||

Michael Kennedy

Mr. Kennedy has served since August 2011 as President of Landauer Medical Physics, a subsidiary of Landauer Inc., and Vice President Global Marketing for Landauer Inc. Mr. Kennedy has over twenty five years of healthcare technology innovation and commercial leadership experience in both Fortune 500 and smaller private healthcare companies. Prior to joining Landauer, he held executive positions in strategic marketing, operations, product development, and general management at Baxter Healthcare, GE, and private healthcare companies. In these roles, he led significant medical device innovations and business transformations in dialysis, blood component therapy, inhaled drug delivery, and diagnostic imaging lifecycle management services. Mr. Kennedy received a Bachelor of Science in chemical engineering from the University of Washington and an MBA from the J.L. Kellogg Graduate School of Business at Northwestern University.

Age: 57

Position: President, Landauer Medical Physics and Vice President Global Marketing, Landauer Inc.

There are no family relationships between any director or executive officer and any other director or executive officer of the Company.

BOARD OF DIRECTORS AND COMMITTEES

During fiscal 2012,2014, the Board of Directors held a total of 75 meetings. No director attended fewer than 75 percent of the aggregate of the total number of meetings of the Board of Directors and the total number of meetings held by all Committees of the Board of Directors on which such director served during the periods that such director served.

The Board of Directors has an Audit Committee, Compensation Committee, and Governance and Nominating Committee. The Audit Committee assists the Board of Directors in fulfilling its oversight responsibilities with respect to financial reports and other financial information and recommends to the Board of Directors the appointment of independent public accountants. The Board of Directors has determined that Michael T. Leatherman,Robert J. Cronin, David E. Meador and Thomas M. White each qualify as an “audit committee financial expert” as defined for the purpose of SEC regulation. The Compensation Committee approves all executive compensation and has responsibility for granting equity awards to eligible members of management and administering the Company’s equity and incentive compensation plans. The Governance and Nominating Committee establishes corporate governance policy and selects nominees for the Board of Directors. (See “Process for Nominating Directors.”) The membership of each Committee consists solely of non-employee directors who meet the independence standards established by the New York Stock Exchange (“NYSE”). During fiscal 2012,2014, the Audit Committee met 79 times including the meetings required to conduct its quarterly financial reviews, the Compensation Committee met 58 times, and the Governance and Nominating Committee met 4 times.

Each Committee has adopted a formal written charter, approved by the full Board of Directors, which specifies the scope of the Committee’s responsibilities and procedures for carrying out such responsibilities. A copy of each charter is available on the Company’s website athttp://www.landauer.com and printed copies are available from the Company on request. The Board of Directors has also adopted Governance and Nominating Standards, a Code of Business Conduct and Ethics applicable to all directors and employees and a Code of ConductEthics for Senior Financial Executives applicable to the principal executive, financial and accounting officers of the Company. Copies of each of these documents are available on the Company’s website athttp://www.landauer.comand printed copies are available from the Company on request. The Company intends to post on its website any amendments to its Code of Business Conduct and Ethics or Code of ConductEthics for Senior Financial Executives applicable to such senior officers.

| 11 |

PROXY STATEMENT | Election of Directors | |

BOARD LEADERSHIP STRUCTURE AND ROLE IN RISK OVERSIGHT

The Board of Directors has determined that having an independent director serve as chairman of the Board of Directors is in the best interest of stockholders at this time. The structure ensures a greater role for the independent directors in the oversight of the Company and active participation of the independent directors in setting agendas and establishing priorities and procedures for the work of the Board.Board of Directors. No single leadership model is right for all companies at all times, however, so the Board of Directors conducts an annual evaluation in order to determine whether it and its committeesCommittees are functioning effectively and recognizes that, depending on the circumstances, other leadership models might be appropriate. Accordingly, the Board of Directors periodically reviews its leadership structure.

The Board of Directors is actively involved in oversight of risks inherent in the operation of the Company’s businesses and the implementation of its strategic plan. The Board of Directors performs this oversight role by using several different levels of review. In connection with its reviews of the operations of the Company’s business segments and corporate functions, the Board of Directors addresses the primary risks associated with those segments and functions. In addition, the Board of Directors reviews the key risks associated with the Company’s strategic plan at an annual strategic planning session and periodically throughout the year as part of its consideration of the strategic direction of the Company.

The Board of Directors has delegated to the Audit Committee oversight of the Company’s risk management process. The Audit Committee (a) reviews with management the Company’s significant risk exposures and policies regarding the assessment and management of risk, (b) serves as an independent and objective body to monitor the Company’s financial reporting process and internal control systems, and (c) assists the Board of Directors in oversight of the Company’s compliance with legal and regulatory requirements. Each of the other committeesCommittees of the Board of Directors also oversees the management of Company risks that fall within the committee’sCommittee’s areas of responsibility. The Governance and Nominating Committee oversees risks related to the Company’s governance structure and processes and the structure of the Board of Directors and its committeesCommittees to ensure appropriate oversight of risk. The Compensation Committee considers risks related to the design of the Company’s compensation program and arrangements for the Company’s named executive officers.

Management has periodically undertaken, and the Compensation Committee has reviewed, an evaluation of Landauer’s compensation policies and procedures as they relate to risk management practices and risk-taking incentives. Based upon that evaluation, the Company has concluded that its compensation program does not create risks that are reasonably likely to result in a material adverse effect. In reaching this determination, the Company has taken into account the following design elements of Landauer’s compensation program and policies and practices: mixture of cash and equity payouts, mixture of performance time horizons, use of financial metrics that are easily capable of audit, avoidance of uncapped rewards, use of required stock ownership amounts at senior management levels, adherence to a broad clawback policy, anti-hedging and pledging policies, and a rigorous auditing, monitoring and enforcement environment.

Under the Company’s Governance and Nominating Standards, a majority of the Board of Directors should be composed of Independent Directors as that term is defined in the New York Stock Exchange (“NYSE”)NYSE listing standards. A director is independent under the NYSE listing standards if the Board affirmatively determines that the director has no material relationship with the Company directly or as a partner, stockholder or officer of an organization that has a relationship with the Company.

The Board has affirmatively determined that all directors, with the exception of William E. Saxelby,Michael T. Leatherman, are considered independent under the independence standards of the NYSE. In reaching this determination, the Board considered the relationship of Mr. Dempsey’s membership on the board of a customer of the Company, and the relationship of one of Mr. Meador’s employer’s facilities as a customer of the Company. The Board determined that these relationships are not material. The Board has also concluded that no non-employee director has any of the disqualifying relationships identified by the NYSE.Consequently,NYSE. Consequently, the Board has determined that all non-employee directors are independent within the meaning of the NYSE listing standards. The Company’s independent directors are Robert J. Cronin, William G. Dempsey, Michael T. Leatherman,

| 12 |  |

Election of Directors | PROXY STATEMENT | |

David E. Meador, Stephen C. Mitchell, and Thomas M. White. Given his current employment by Landauer, William E. SaxelbyMichael T. Leatherman is not at this time considered independent under the independence standards of the NYSE. The Company’s independent directors meet in regularly scheduled executive sessions and at other times, as they deem appropriate. Robert J. Cronin, Chairman of the Board of Directors, presides at these sessions.

PROCESS FOR NOMINATING DIRECTORS

Landauer’s Governance and Nominating Committee establishes and oversees adherence to the Board’s Governance and Nominating Standards, and establishes policies and procedures for the recruitment and retention of Board members. The Governance and Nominating Committee is comprised of three members, each of whom meets the independence requirements established by the New York Stock ExchangeNYSE with respect to Governance and Nominating Committees.

The Governance and Nominating Committee will consider nominees for the Board of Directors who have been properly and timely recommended by stockholders. Any recommendation submitted by a stockholder must include the same information concerning the candidate and the stockholder as would be required under Section 1.4 of the Company’s bylawsby-laws if the stockholder were nominating that candidate directly. Those information requirements are summarized in this Proxy Statement under the caption “Stockholder Proposals.” The Governance and Nominating Committee will apply the same standards in considering director candidates recommended by stockholders as it applies to other candidates. The Governance and Nominating Committee has not established any specific, minimum qualification standards for nominees to the Board.Board of Directors. From time to time, the Governance and Nominating Committee may identify certain skills or attributes (e.g. healthcare industry experience, technology experience, financial experience) as being particularly desirable for specific director nominees.TheGovernance and Nominating Committeeconsiders diversity of backgrounds and viewpoints when considering nominees for director but has not established a formal policy regarding diversity in identifying director nominees.

To date, the Governance and Nominating Committee has identified and evaluated nominees for director positions based on several factors, includingincluding: referrals from management, existing directors, advisors and representatives of the Company or other third parties,parties; business and board of director experience,experience; professional reputationreputation; and personal interviews. Each of the current nominees for director listed under the caption “Election of Directors” is an existing director standing for re-election.

COMMUNICATIONS WITH THE BOARD OF DIRECTORS

BY STOCKHOLDERS AND OTHER INTERESTED PARTIES

The Company’s Annual Meeting of Stockholders provides an opportunity each year for stockholders and other interested parties to ask questions of or otherwise communicate directly with members of the Company’s Board of Directors on matters relevant to the Company. Each of the Company’s directors is requested to attend the Annual Meeting in person. All of the Company’s directors attended the Company’s 20122014 Annual Meeting of Stockholders. In addition, stockholders and other interested parties may, at any time, communicate in writing with the full Board of Directors, any individual director or any group of directors, by sending such written communication to the full Board of Directors, individual director or group of directors at the following address: Landauer, Inc., 2 Science Road, Glenwood, Illinois 60425; Attention: Corporate Secretary. Copies of written communications received at such address will be provided to the addressee unless such communications are considered, in the reasonable judgment of the Corporate Secretary, to be improper for submission to the intended recipient(s). Examples of such communications that would be considered improper for submission include, without limitation, customer complaints, solicitations, communications that do not relate directly or indirectly to the Company or the Company’s business or communications that relate to improper or irrelevant topics.

| 13 |

PROXY STATEMENT | Executive Compensation – Compensation Discussion and Analysis | |

Compensation Discussion and Analysis

COMPENSATION DISCUSSION AND ANALYSIS

Landauer is required to provide information regarding the compensation program in place for its CEO, CFO and the three other most highly compensated executive officers as of its last fiscal year end as well as certain other persons specified in SEC rules. The Company has only three executive officers, including the CEO and CFO. Information regarding the compensation paid to these individuals is included in this Proxy Statement. Effective September 9, 2011 through December 31, 2011,one of the Company’s Directors, Michael T. Leatherman, served as Interim CFO. Effective January 3, 2012, Michael K. Burke was appointed CFO. Accordingly, the Company has included compensation disclosure for both individuals that served as its principal financial officer during the year. In addition, the Company included compensation disclosure for Richard E. Bailey who served as Senior Vice President – Operations, until his retirement effective December 31, 2011. In this proxy statement, the Company refers to the individuals as to whom compensation disclosure is required as the “Named Executive Officers” or “NEOs.” This section includes information regarding, among other things, the overall philosophy of the Company’s NEOexecutive compensation program and each element of compensation that it provides to executives, including NEOs.

Our NEOs for the year ending September 30, 2014 are:

SUMMARY OF CHANGES TO COMPENSATION AND GOVERNANCE POLICIES AND DESIGN Landauer performed below expectations in fiscal 2014 and as a result, performance-based compensation was adjusted accordingly as discussed further in this Compensation Discussion and Analysis (“CD&A”). In addition, significant management changes occurred during fiscal 2014 including the departure of Mr. Saxelby, Landauer’s former CEO and Mr. Burke, Landauer’s former CFO. Severance payments were made to both executives consistent with the Executive Severance Plan for Mr. Burke and consistent with the employment agreement in place for Mr. Saxelby. Additional information regarding such payments is found on pages 35-36 below under the heading, “Severance Agreements”. At the 2014 Annual Meeting, the Company’s executive compensation program was approved by 74.6% of the votes cast on the “say-on-pay” proposal, which represented a significant decrease from the 2013 and 2012 annual meeting say-on-pay votes. This led the Company to undertake an in-depth review of its compensation policies and practices and to continue its dialogue with shareholders regarding its compensation policies. As a result of this review and dialogue, the Compensation Committee has taken the following steps since the 2014 Annual Meeting to address shareholder concerns:Michael T. Leatherman, Interim President and Chief Executive SummaryOfficer (effective September 15, 2014)Mark A. Zorko, Interim Chief Financial Officer (effective June 21, 2014)R. Craig Yoder, Senior Vice President, Technology & International BusinessMichael P. Kaminski, President, Radiation MeasurementMichael R. Kennedy, President, Landauer Medical Physics and VP Global MarketingWilliam E. Saxelby, former President and Chief Executive Officer (through September 15, 2014)Michael K. Burke, former Senior Vice President and Chief Financial Officer (through June 20, 2014)The Company modified its compensation policies as follows: • Amended the Company’s Incentive Compensation Plan and its Executive Special Severance Plan to provide for double-trigger vesting of all future equity grants upon a change in control (making all payments payable under these plans double trigger); • Amended the Company’s Incentive Compensation Plan to provide that upon a termination of employment without cause, annual bonus and stock awards vest on a pro-rata basis based on service through the date of termination and in the case of performance-based awards, based on the lesser of actual performance determined on the last day of the performance period and target;

| 14 |  |

Executive Compensation – Compensation Discussion and Analysis | PROXY STATEMENT

| |

| • | Clarified the Company’s policy and limited the circumstances under which the Company may make adjustments and amendments to performance measures for outstanding performance awards under the Incentive Plan; | |||||

| • | Added a peer group as a supplemental data point to assist with compensation decision-making; and | |||||

| • | Clarified and expanded the Company’s anti-hedging policy and adopted an anti-pledging policy. | |||||

The Company enhanced its compensation disclosure by adding the following in this CD&A: | • | A discussion regarding the addition of the peer group; and | ||||

| • | A table summarizing any adjustments made to annual performance results when determining annual incentive payouts | |||||

The Company modified its compensation design as follows: | • | Added two new performance metrics to its long-term incentive awards. In fiscal 2014, Cumulative Operating Cash Flow (“OCF”) was added to focus management on driving debt reduction and improving the balance sheet. | ||||

| • | For fiscal 2015 and beyond, Return on Invested Capital (“ROIC”) will be added to focus management on achieving an effective return on invested capital | |||||

The Company made the following changes to its governance structure: | • | Adopted majority voting for directors in uncontested elections; and | ||||

| • | Initiated the process to declassify the Board and provide for annual elections of directors. |

Additional information regarding our stockholder outreach and subsequent policy change is found on page 16 below under the heading, “2014 Annual Meeting Executive Compensation Advisor Vote”.

The elements of Landauer’s compensation program for NEOs include base salary, annual non-equity incentive compensation (“annual bonus”), long-term equity incentive compensation, retirement benefits and severance arrangements. The Compensation Committee considered the results of the non-binding advisory shareholder vote on executive compensation at our February 9, 2012 Annual Meeting of Stockholders, at which the overall compensation of the Company’s Named Executive Officers was approved by 97% of the votes cast. Given the high level of stockholder support, the Compensation Committee of the Board of Directors determined that no significant changes to the Company’s executive compensation philosophy and principles were required during fiscal 2012 as a result of the vote.

During fiscal 2012,2014, the following compensation actions were taken:

Landauer’s Compensation Philosophy and Principles

Landauer designs its compensation program to maintain a performance and achievement-oriented environment throughout the Company, while ensuring the program does not create unnecessary or excessive risk. The goals of the Company’s executive compensation program are to:

| 15 |

PROXY STATEMENT | Executive Compensation – Compensation Discussion and Analysis | |

Consistent with these goals, the Board has developed and approved an executive compensation philosophy to provide a framework for the Company’s executive compensation program. The key components of this philosophy are:

The executive compensation philosophy results in three major components of executive compensation: a competitive base salary reflective of the individual’s role, responsibilities, experience and capabilities; non-equity incentive compensation tied to Company and individual annual performance; and long-term equity incentives tied to Company performance and individual level of responsibility to impact results over time. The Company determines the appropriate level of these components by using market compensation information as described more fully below.

2014 Annual Meeting Executive Compensation Advisory Vote

Landauer performed below expectations in fiscal 2014 and as a result, performance-based compensation was adjusted accordingly as discussed further in this Compensation Discussion and Analysis (“CD&A”). In addition, significant management changes occurred during fiscal 2014 including the departure of Mr. Saxelby, Landauer’s former CEO and Mr. Burke, Landauer’s former CFO. Severance payments were made to both executives consistent with the Executive Severance Plan for Mr. Burke and consistent with the employment agreement in place for Mr. Saxelby.

Additional information regarding such payments is found on pages 35-36 below under the heading, “Severance Agreements”. At the 2014 Annual Meeting, the Company’s executive compensation program was approved by 74.6% of the votes cast on the “say-on-pay” proposal, which represented a significant decrease from the 2013 and 2012 annual meeting say-on-pay votes. This led the Company to undertake an in-depth review of its compensation policies and practices and to continue its dialogue with shareholders regarding its compensation policies. As a result of this review and dialogue, the Compensation Committee has taken the following steps since the 2014 Annual Meeting to address shareholder concerns:

| 16 |  |

Executive Compensation – Compensation Discussion and Analysis | PROXY STATEMENT | |

In each case, these changes underscore the Company’s commitment to pay-for-performance. All of these changes are designed to further align the executives’ interests with shareholders and compensate executives on the basis of actual performance.

The Compensation Committee

The Compensation Committee assists the Board of Directors in fulfilling the Board’s oversight responsibilities to administer the Company’s executive compensation program. Each member of the Committee is independent as defined in the corporate governance listing standards of the New York Stock Exchange,NYSE, Landauer’s director independence standards and applicable law and SEC regulations.

The Committee reports to the Board of Directors on all compensation matters regarding Landauer’s executives and other key salaried employees. The Committee reviews annually and approves or recommends to the Board of Directors for approval, as applicable, the compensation (including annual base salary, annual non-equity incentive compensation, long-term equity incentive compensation and other employee benefits) for the Company’s executives and other key salaried employees. Further information about the Committee’s responsibilities is contained in the Committee’s Charter, which is available in the “Corporate Governance” section on the “Investor Relations” page of Landauer’s website atwww.landauer.com.

Roles of Consultants and Executives

During and after the end of each fiscal year, the CEO provides the Compensation Committee with feedback regarding the performance of the NEOs.executives and key salaried employees. Annually, and in the cases of NEOexecutive promotions or hires, the CEO makes recommendations to the Compensation Committee regarding the compensation package for each of the NEOsexecutives (other than himself). Based on its review of individual performance (taking into account input from the CEO), input andmarket data from its independent compensation consultant and other factors, the Compensation Committee makes recommendations to the Board regarding the compensation for the CEO and the other NEOs.executives. Acting upon the recommendation of the Compensation Committee, the independent members of the Board, meeting in executive session, determine the compensation of the CEO and the other executives, including NEOs.

To assist the Compensation Committee in discharging its responsibilities, the Committee retains Hay Group, Inc. as its independent compensation consultant. Hay Group is entirely independent and as such its work for the Compensation Committee does not raise any conflict orof interest. Hay Group’s independence is reviewed annually in accordance with NYSE listing standards. The consultant’s role is to advise the Committee on all executive compensation matters. Biennially, Hay Group presents the Compensation Committee withsurvey data and information about other relevant market practices and trends, and makes recommendations to the Compensation Committee regarding target levels for various elements of total compensation for senior executives, which the Compensation Committee reviews and considers in its deliberations. Hay Group completedits most recent biennial executive compensation analysis in fiscal 2012.

2014.

The Committee’s independent compensation consultant reports directly to the Compensation Committee. Periodically the CEO and CFO may work directly with the Committee’s consultant primarily in the development of offers for new hires and assistance on the development of recommendations on the design of its compensation program to be presented to the Compensation Committee or the Board of Directors. This interaction between the Committee’s consultant and

| 17 |

PROXY STATEMENT | Executive Compensation – Compensation Discussion and Analysis | |

management takes place under the approval of the Compensation Committee Chair. During fiscal 2012,2014, management worked with the compensation consultant on compensation for severalcertain roles in the organization, including external hires.

To ensure that its executive officer compensation is competitive in the marketplace, the Company uses a formal job evaluation methodology to determine both the internal and external equity of its NEOs’ total compensation. Internal equity is considered in order to ensure that members of Landauer’s executive management are compensated at an appropriate level relative to other members of its executive management, while external equity is a measure of how the Company’s compensation of its executive management compares to compensation for positions with comparable job content at other companies. Hay Group reviews each executive position using its proprietary method of job evaluation to assess the position’s relative scope. In this process, Hay considers the breadth of responsibilities, the complexity of the role, and the role’s impact on the success of the business. Once each job is valued independently, Hay Group compares the jobs to determine relative relationships and then relates these job content scopes to pay opportunity levels based on compensation market data from Hay Group’s Industrial Executive Compensation Report, a proprietary annual executive compensation survey with data on more than 100 executive level positions from over 300 organizations. Given that Landauer competes in a market with limited competitors, the Compensation Committee has determined that utilizing a broad industry survey with a focus on publicly traded companies and significant survey participation by the manufacturing sector, such as the Hay Group survey, is an appropriate method forevaluating the Company’s executive compensation practices.

All components of Landauer’s executive compensation program are aligned around the 50th50th percentile of Hay Group’s survey data for targeted performance. For short-term and long-term incentive compensation, achievement of over performance goals can result in a maximum award equal to 200% of the target opportunity. In the case of long-term incentive compensation, the 75th percentile of Hay Group’s survey data is targeted for achievement of over performance goals. Actual pay will vary above or below the 50th50th percentile depending on a number of factors including individual performance, tenure with the organization and overall Company performance.

With the assistance of the compensation consultant, the Compensation Committee annually reviews relevant compensation market data, trends and best practices in executive compensation, and executive pay tallies for the Company’s NEOs to ensure that the design of its program is consistent with its compensation philosophy and that the amount of compensation is within appropriate competitive parameters. Based on this review, the Compensation Committee has concluded that the total compensation of each NEO and, in the case of the severance and change-in-control scenarios, potential payouts are appropriate and reasonable.

During fiscal 2014, the Compensation Committee worked with Hay Group to revise its peer group, which historically has been used only to benchmark director compensation. For fiscal 2015 and beyond, the purpose of this revised peer group will be to (1) benchmark the Company’s director compensation and (2) provide the Committee with supplemental compensation data for NEO benchmarking. However, the Compensation Committee will continue to rely on the aforementioned survey data as its primary benchmarking data source.

Interim CFO CompensationAs part of its peer group review, Hay Group developed a set of companies based on Landauer’s GICS code (3510 – Health Care Equipment and Services) and annual revenues comparable to Landauer. This set of companies was then reduced by selecting companies with market capitalizations comparable to Landauer, and primary business focus on either (1) design and manufacturing of medical devices and/or (2) diagnostic, analytic, imaging and/or testing services in the life sciences and health care markets. The resulting group of twenty-two companies is listed below:

The Board of Directors of the Company appointed one of its Directors, Michael T. Leatherman, as the Company’s Interim CFO, as well as its acting principal financial officer and acting principal accounting officer, each effective from September 9, 2011 through December 31, 2011. Mr. Leatherman was paid a monthly salary of $35,000 for each month he served in the role. Mr. Leatherman was also awarded a $75,000 stock grant in recognition of his contributions as Interim CFO, which approximated, on a pro-rata basis, the value of the annual equity award that had been provided to the Company’s prior CFO. The Compensation Committee has concluded that the compensation of the Interim CFO was appropriate and reasonable.

| Abaxis | ABIOMED | Accuray | ||

| Affymetrix | AngioDynamics | Atrion | ||

| BioTelemtry | Cardiovascular Systems | CryoLife | ||

| Endologix | Exactech | ICU Medical | ||

| LDR Holding | Luminex | Meridian Bioscience | ||

| Quidel | Natus Medical | Nxstage Medical | ||

| Tornier NV | RTI Surgical | Spectranetics | ||

| Vascular Solutions |

| 18 |  |

Executive Compensation – Compensation Discussion and Analysis | PROXY STATEMENT | |

Elements of Landauer’s Compensation Program

Landauer’s executive officer compensation package includes a combination of annual cash and long-term incentive compensation. Annual cash compensation for executive officers is comprised of base salary plus annual non-equity incentive bonuses. Long-term incentives consist of a combination of restricted share grants with performance and time-basedtime -based vesting characteristics.

| Element | Purpose | Characteristics | ||

| Base Salary | Compensate executives for their level of responsibility and sustained individual performance. Also help attract and retain strong talent. | Fixed component with eligibility for annual merit increases based on sustained individual performance. | ||

| Annual Non-Equity Incentive Compensation | Promote the achievement of Landauer’s annual financial goals, as well as individual goals. | Performance-based cash opportunity based on Company and individual results as determined by the Compensation Committee as outlined in the “Landauer, Inc. Incentive Compensation | ||

| Long-Term Equity Incentive Compensation | Promote the achievement of Landauer’s long-term corporate goals, support executive retention and encourage executive stock ownership. | Performance-based equity and restricted equity grants based upon achievement of strategic priorities and retention with the Company made annually through the “Landauer, Inc. Incentive Compensation | ||

| Retirement Plans | Provide an appropriate level of replacement income upon retirement. Also provide an incentive for a long-term career with Landauer, which is a key objective of the Company. | Defined contribution retirement plan with Company match and annual profit sharing eligibility with a supplemental deferred compensation contribution available to certain executives. | ||

| Post-Termination Compensation | Facilitate the attraction and retention of high caliber executives in a competitive labor market and provide noncompetition and nonsolicitation covenants for the Company’s protection. | Contingent |

In setting total compensation, Landauer applies a consistent approach for all executive officers. Also, the Compensation Committee exercises appropriate business judgment in how it applies its standard approach to the facts and circumstances associated with each executive. Additional detail about each pay element follows.

Base Salaries:As discussed above, data on salaries paid to comparable positions in the Hay Group survey are gathered and reported biennially to the Compensation Committee by its independent compensation consultant. The Compensation Committee, after receiving input from the compensation consultant, recommends to the Board for its consideration and approvalapproves the salaries for the CEO, CFO, other NEOs and other NEOs.executives. The CEO provides input for the salaries for the CFO and other NEOs.executives. The Compensation Committee seeks generally to establish base salaries for the CEO, CFO and other NEOs around the 50th50th percentile of the Company’s compensationsurvey data,, which is the targeted market position to facilitate the attraction and retention of executive talent. In fiscal 2012, the salarieslight of the NEOs approximated, within a weighted average of 8%,Company’s fiscal 2013 performance, themedian of thecompensationsurvey data NEOs’ base salaries were not increased for their positions.

fiscal 2014.

Annual Non-Equity Incentives: Annual non-equity incentive awards to the CEO, CFO and other NEOsexecutives are paid relative to the targets established annually by the Compensation Committee under the terms of the Landauer, Inc.

| 19 |

PROXY STATEMENT | Executive Compensation – Compensation Discussion and Analysis | |

Incentive Compensation Plan. Annual incentive awards for the CEO, CFO and other NEOsexecutives are intended to promote the achievement of Landauer’s annual financial goals, as well as individual goals. For fiscal 2012,2014, the plan establishes an incentive pool which is related to aggregate executive officer base salary and performance of Landauer relative to (i) budgetedplan revenue and (ii) budgetedplan net income. The fiscal 2012 metrics of revenue and net income as performance targets reflect the long-term strategic priority of the Company toincentivize revenue and earnings growth, which the Company believes represent key drivers ofthe Company’slong-term performance. The Committee believes use of these metrics provides alignment with the interests of Landauer’sstockholders. The Plan is intended to meet the deductibility requirements of Section 162(m) of the Internal Revenue Code as performance-based pay, and our expectation is that this will result in paid awards being fully deductible by the Company for federalincometax purposes. stockholders.

Similar to the process for base salary, data for non-equity incentives paid to comparable positions in the Hay Group survey are gathered and reported biennially to the Compensation Committee by the independent compensation consultant. The Compensation Committee, after receiving input from the compensation consultant, approves or recommends to the Board for its consideration and approval, as applicable, the non-equity incentives for the CEO, CFO and other NEOs.executives. The target incentive compensation award (“ICA”), as a percentage of individual executive officer base salary, is 50% for the Chief Executive Officer and 40% for the CFO and other NEOs. These payout ratios are determined based upon targeting total cash compensation (base salary plus non-equity incentive compensation) around the 50th percentile as determined by the survey studyperformedstudy performed by the Committee’s independent compensation consultant. The actual size of the incentive compensation pool available for award varies based upon actual financial performance for revenue and net income.

The revenue and net income targets are established as part of the annual operating planning process. The targets are recommended by management, reviewed by the Compensation Committee and approved by the Board. The targets are intended to be representative of strong financial performance by the Company based upon market conditions and the expectations of stockholders. The scales of the payout ratios are intended to compensate management for the perceived effort required to achieve the targeted performance and reward management for the effort required to deliver results beyond expected levels.

The revenue and net income targets for fiscal 20122014 were established as follows ($’s in millions):

| Revenue | $ | 162.5 | ||

| Net Income | $ | 22.1 |

| ICP Performance Measure | Threshold | Incentive Performance (in $ millions) Target | Maximum | |||||||||

Revenue (weighted 30%) | $ | 123.2 | $ | 154.0 | $ | 184.8 | ||||||

Net Income (weighted 70%) | $ | 17.0 | $ | 18.0 | $ | 21.6 | ||||||

Both the revenue and net income targets were establishedwithout considering the impact of certain non-recurring costs relating to acquisition and reorganization costs and the impact of intangible amortization for acquisitions completed during the fiscal year.

Based on the Company’s fiscal 2013 net income performance, the Compensation Committee approved fiscal 2014 net income performance goals that set target performance at $18 million, which was the high end of fiscal 2014 guidance, with the threshold performance level set at $17 million, which represented the midpoint of fiscal 2014 guidance. The Committee felt that requiring this level of net income performance before paying out threshold awards or higher aligned management with shareholder interests. The maximum performance level was set at $21.6 million, which represents 120% of the fiscal 2014 target of $18 million.

The fiscal 2014 plan provides for a payout at a ratio of targeted incentive compensation as follows:

| Actual Revenue Performance | Payout Ratio | |||

120% Incentive Revenue | 200% of target award | |||

100% Incentive Revenue | 100% of target award | |||

80% Incentive Revenue | 50% of target award | |||

<80% Incentive Revenue | 0% of target award |

| 20 |  |

Executive Compensation – Compensation Discussion and Analysis | PROXY STATEMENT | |

| Actual Net Income Performance | Payout Ratio | |

120% Incentive Net Income Achievement ($21.6 million) | 200% of target award | |

100% Incentive Net Income Achievement ($18 million) | 100% of target award | |

94% Incentive Net Income Achievement ($17 million) | 50% of target award | |

<94% Incentive Net Income Achievement | 0% of target award |

The range of the scale for revenue and net income achievement is intended to align management with the expectations of stockholders on earnings growth. Performance below 80% of planned revenue and 94% of net income would be considered to be below the Company’s expectations and, accordingly, results in zero payout of the target award.award. Similarly, performance at 120% to planof target is believed to represent performance well beyond the expectations of the business. Awards for performance between 80% for revenue and 94% for net income and 120% of goal are determined by linear interpolation withthe performance goals results in payouts ranging from 50% to 200% of targeted award. The overall payout ratio maintainsis intended to maintain alignment with the expectations of stockholders on minimum performance.

The amount of potential ICA for any executive officer is determined by multiplying the executive’s base salary times the actual incentive award percentage. The actual ICA percentage is the target award percentage of 50% or 40% multiplied by the percentage of target award determined by the weighted average of the revenue and net income components in the following ratio:

Revenue | 30% | |||

Net Income | 70% |

Two-thirds of the target ICA is payable to the executive officer based solely on financial performance of the Company. With respect to the one-third balance remaining in the pool for the fiscal year, the Compensation Committee will have the discretion to award any executive officer an amount ranging from zero to one-third of the award such executive officer would otherwise receive based upon achievement against personal management objectives (“PMO”). Accordingly, the total ICA is calculated as follows:

Potential ICA | = | ||||

Actual ICA | = |

PMOs are established annually and are aligned with the strategic priorities of the Company. PMOs are intended to be challenging but generally capable of being achieved. PMOs for the Company’s NEOs in fiscal 20122014 included:

Any amounts related to PMO achievement not so awarded may, at the discretion of the Committee, be reallocated, in whole or in part, to any other executive officer based upon the Committee’s evaluation of the individual performance of the executive officer relative to written objectives and other factors, including the CEO’s annual report to the Committee of the executive officer’s performance.

The individual and aggregate amounts of incentive compensation awards for the fiscal year, as approved by the Compensation Committee, are limited to 200% of the targeted awards.

Recognizing that extraordinary positiveThe Incentive Compensation Plan permits the adjustment of performance measures upon the occurrence of certain non-recurring events, including asset write downs, litigation claims, judgments or negative non-operating events cansettlements, accruals for reorganization and do occur,restructuring programs, objectively determinable legal, integration, or deal related costs in connection therewith or changes in law or accounting principles. For fiscal 2014, no such adjustments were made. Following the 2014 annual meeting the Committee may electreviewed the Company’s practice and policy concerning adjustments to performance measures,

| 21 |

PROXY STATEMENT | Executive Compensation – Compensation Discussion and Analysis | |